Passive Income, Exemptions, Deductions & Tax Free Download

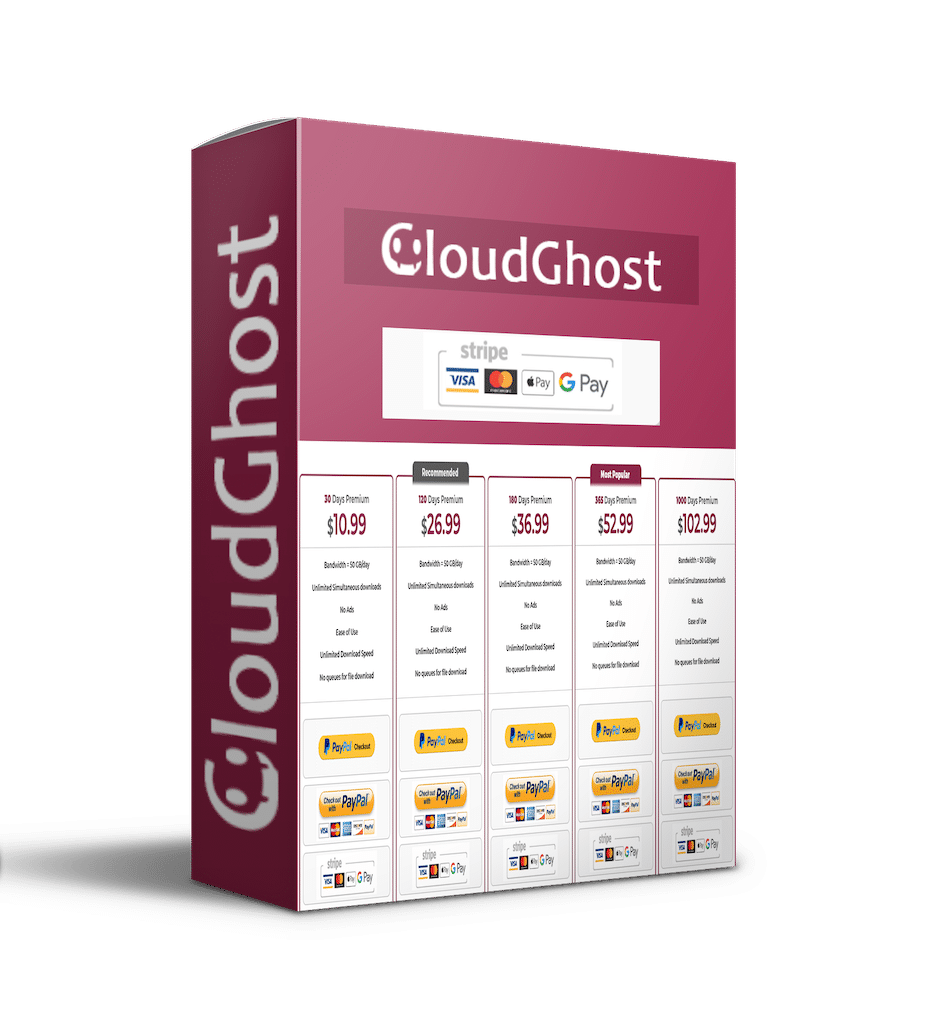

https://www.udemy.com/course/passive-income-exemptions-deductions-tax/

Practical approach to Passive Income, Exemptions, Deductions & Tax

What you’ll learn

Gross Income

Passive income exemptions

Deductions

Capital

Royalties paid to non-residents

Requirements

No prerequistes required

Description

*Please note that this course is based on South African Tax*As a tax professional, learners are immediately confronted with large volumes of detailed tax theory, and struggle to understand how the theory fits into the end goal of preparing tax computations.This course has been designed to develop a foundation of simple application upon which the complexities of taxation can be built at a later stage. The approach is practical rather than theoretical.Topics Discussed:Gross IncomeTotal AmountIn cash or otherwiseReceived by or accrued toCapitalResidenceSourceSource in terms of section 9Passive income exemptionsNon-resident’s interest exemptionNatural person’s interest exemptionSouth African dividends – section 10 (1)(k)(i)Dividends and interest paid as an annuityRoyalties paid to non-residentsPurchased annuitiesForeign dividendsDeductionsAll Included:Video presented courseDownloadable course materialCertificate of trainingAssessment (optional)SAIT Accredited – 4 Verifiable CPD PointsAbout the Presenter:Ruzel van JaarsveldRuzel has over 26 years financial and bookkeeping experience, working with many industries and corporate environments, with extensive knowledge and practical application of trial balance, payroll, VAT, PAYE returns, Inventory control, Management Accounts, E-filing and Procedures of Importing and Exporting.Ruzel is a seasoned appointed facilitator with Biz Facility, and for numerous years has been presenting various national practical financial workshops to business owners and corporate financial staff.